It’s that time of year again – HMRC has released their yearly R&D Tax Credit report, detailing the breakdown of the most recent years claims!

Over £35 billion has been spent by businesses all over the UK and identified as being eligible R&D expenditure for claiming R&D Tax Credits. This has resulted in over £5.3 million being paid out to the 57,335 businesses that have made a R&D Tax claim for financial year 2018-19; with the total value estimated to rise to £6.3 billion once all claims have been processed.

The Breakdown

Let’s look at a breakdown of both the SME Scheme and RDEC Scheme statistics, looking at how many claims have been made, how much has been claimed and by which industry sectors!

Let’s look at a breakdown of both the SME Scheme and RDEC Scheme statistics, looking at how many claims have been made, how much has been claimed and by which industry sectors!

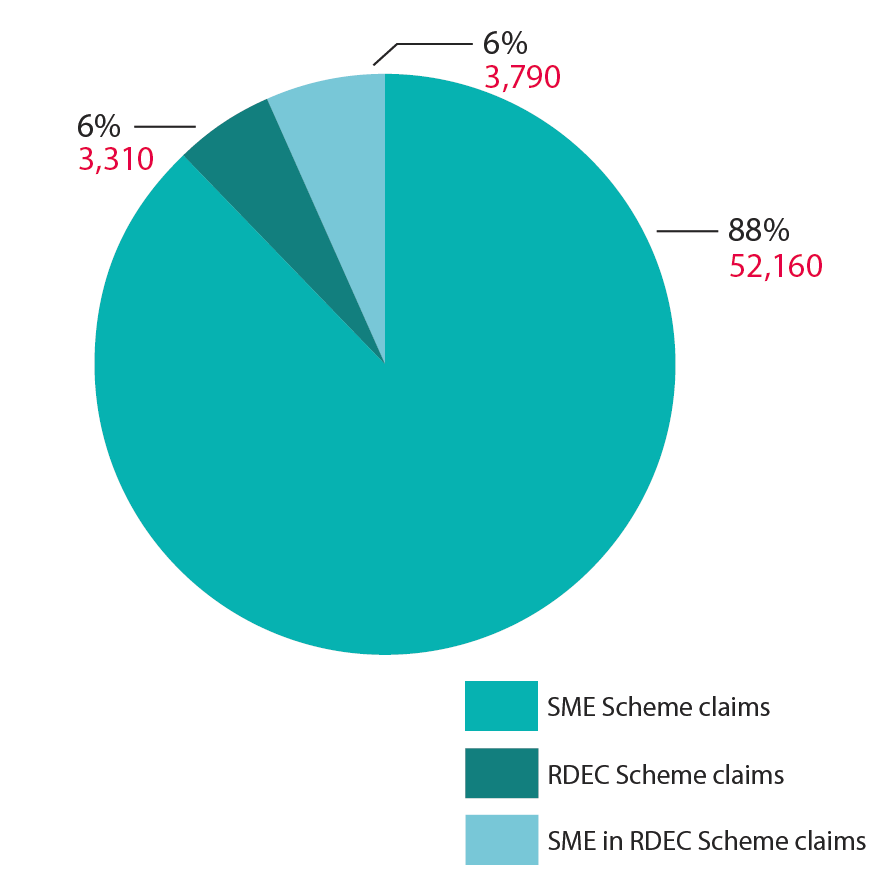

How many claims?

59,265 claims have been made for Financial Year 2018-19 so far; 52,160 of those were made by SME’s into the SME Scheme, 3,310 were made by large companies into the RDEC Scheme, with an additional 3,790 SME claims made a via the RDEC Scheme.

The total amount of claims is due to rise as more claims are made during the 2-year retrospective claim period. In previous years, the number of claims has increased by 17%-20%, meaning the total claims for the financial year 2018-19 could be around 70,000!

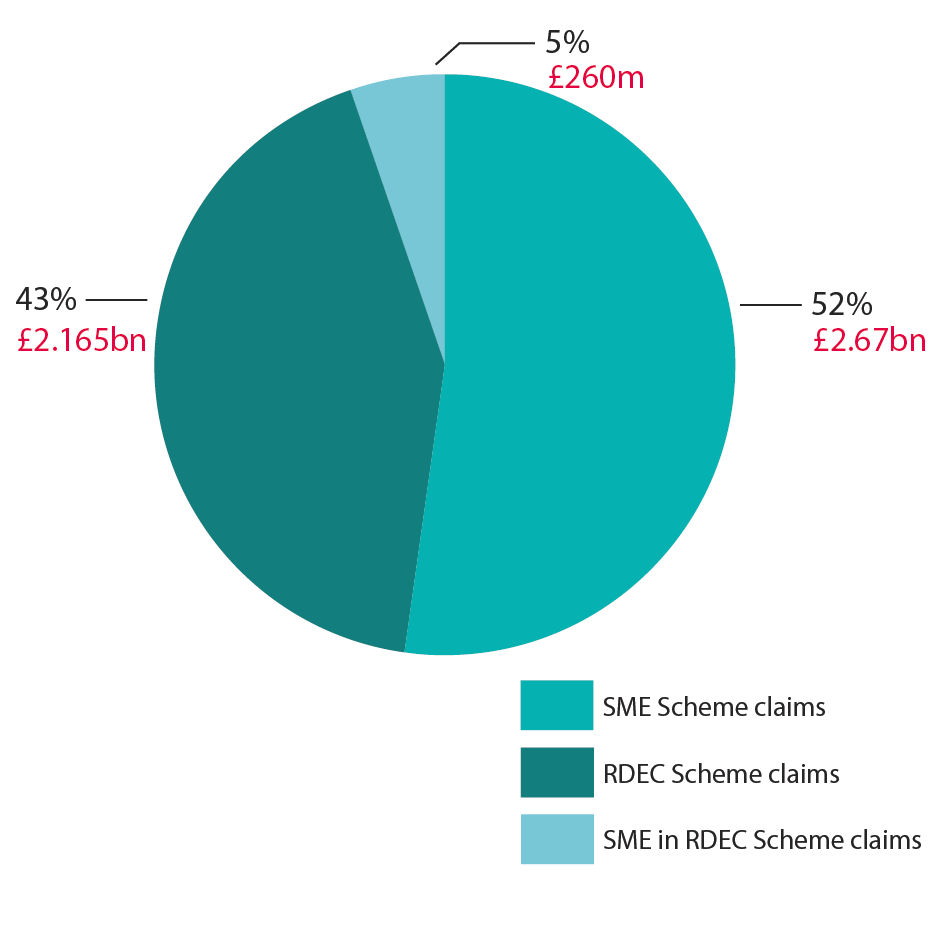

How much has been claimed?

The £5.3 billion of R&D Tax benefit received is split between the same 3 categories:

The £5.3 billion of R&D Tax benefit received is split between the same 3 categories:

- R&D Tax benefit claimed via the SME Scheme is £2.67 billion.

- For Large Companies claiming RDEC, the total is £2.165 billion.

- SME’s claiming via RDEC have received £260 million.

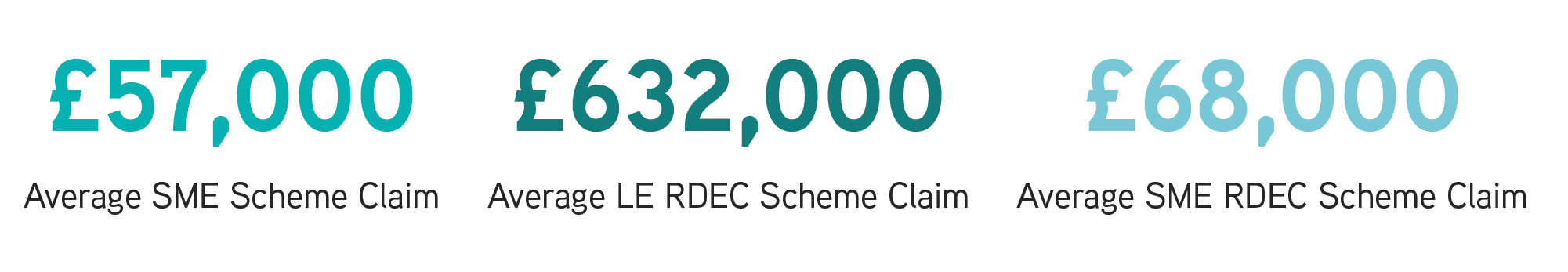

Average Claim Values

Within the current statistics, the average claim for a SME Scheme claim is £57,000 – reflecting a similar average from the previous year.

Large enterprises claiming RDEC benefited £632,000 on average, while SME’s claiming under the RDEC scheme received £68,000.

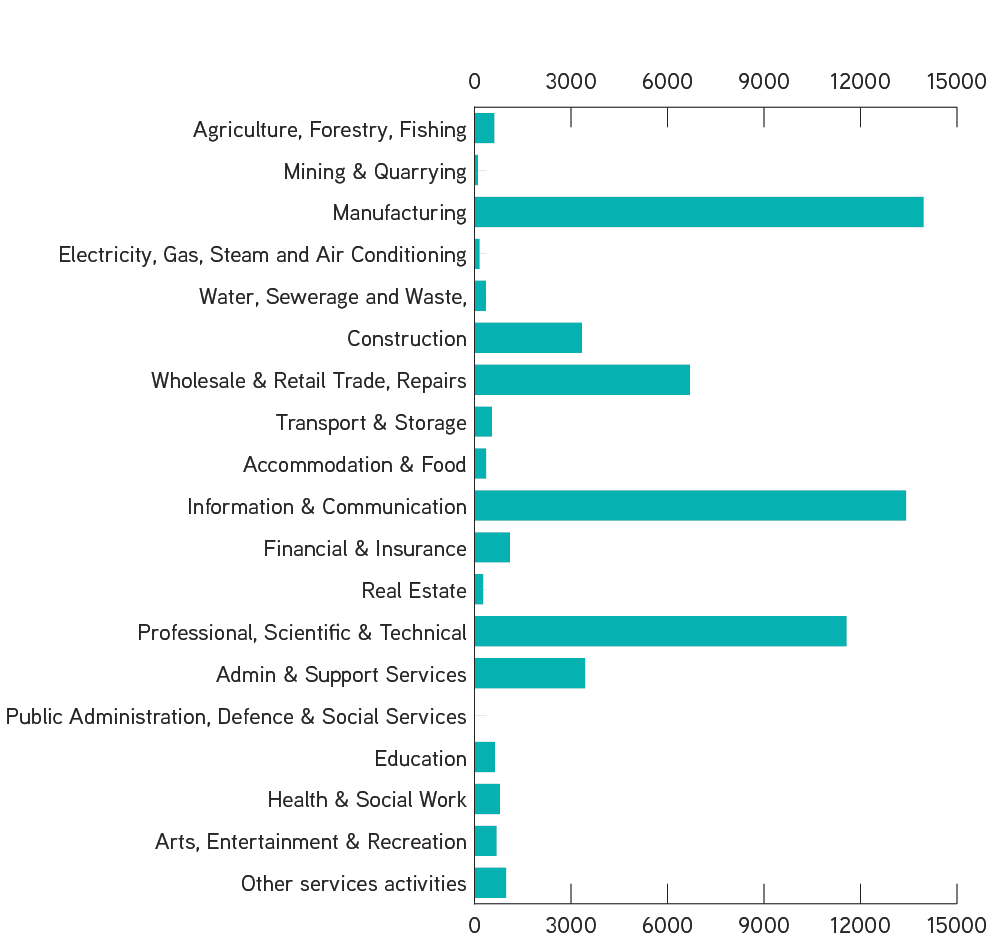

Industry Sector Breakdown

The statistics show that there are 3 industry sectors that have made 67% of the R&D Tax Credit claims for 2018-19:

- Manufacturing (24%)

- Information & Communication (23%)

- Professional, Scientific & Technical (20%)

By claim value, these 3 industries have also claimed a huge 71% of the £5.3 billion tax relief.

Following the top 3, the next 4 largest claimant sectors are:

- Wholesale & Retail Trade, Repairs

- Admin & Support Services

- Construction

- Financial & Insurance

New Claimants

We’re thrilled to see that so many UK businesses, across a variety of sectors, are recognising the benefit of claiming R&D Tax Credits for the R&D they’ve performed and making the most of both schemes available.

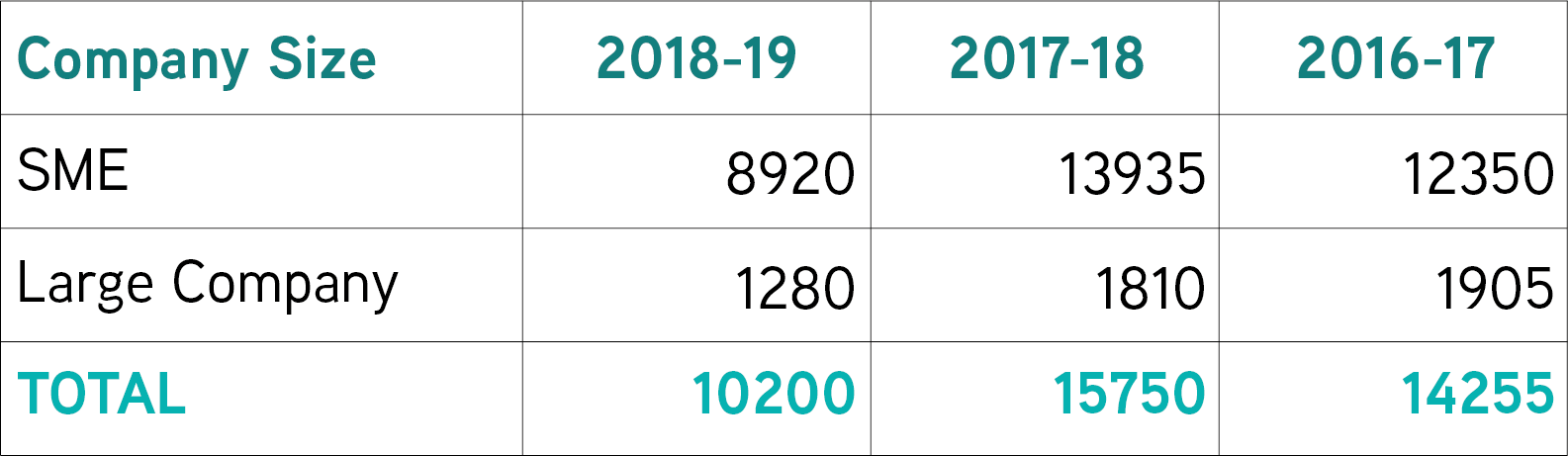

We’re especially excited about the news that 10,200 of the businesses that have claimed for 2018-19 are new claimants, that’s 17.8% of all businesses that claimed!

As with previous years, the number of new claimants is expected to grow as more claims are made. It’s anticipated that the total will reflect the growth from previous years.

This article was written by Medilink EM PAtron, TBAT Innovation.